Whenever I walk into an “eco-friendly” shop, or pick up the free-range, organic, or “certified” product equivalent of what I need, I’m regularly surprised at how much more expensive it is from the presumably “less” sustainable alternative. But why? Is it because clever marketeers have realized that I, as a conscientious consumer, will pay more for something labeled “sustainable”? Is it because it costs more to produce the sustainable alternative? Is it because sustainable alternatives are new to the market and less likely to have achieved economies of scale?

Unhelpfully, the answer is likely all of the above, so figuring out the reason a certain product or service is more costly can be tricky. In this article, we’ll explore the hidden costs and benefits of sustainable products, and how governments and private markets are responding to these additional economic forces.

Point number one: the economic argument as to why sustainable goods should cost more than their less sustainable alternative is rooted in the concept that someone has to pay for the extra cost (or benefit) to the rest of the world of goods exchanged in a transaction. Point number two: the commercial reason is that businesses have realized that they can charge a premium for products labeled “sustainable” or “eco-friendly”.

The economic principle behind this is market segmentation: the “sustainable” label enables the business to sell in the market of sustainable products that are considered by consumers to be different from their non-sustainable counterparts. Both of these forces are typically at play whenever you buy a “more sustainable” good or service, compounding the price differential..

Let’s look first at the economic principles involved. As an example, caring for the soil by rotating crops, providing space for wildflowers that attract pollinators, and pursuing biodiversity all cost more money than industrial monoculture-based farming. This is primarily because industrial monoculture-based farming benefits from economies of scale. This type of farming is more economically efficient primarily because machinery can be deployed to support planting and harvesting.

Machinery, however, is specific to the crop being planted or harvested; in order to justify the investment in a combine harvester, you have to farm a lot of oats, soybean, rye or wheat – the crops that can be harvested with that type of machine. You can’t harvest strawberries with machinery of this type, for example, unless you are trying to make a seriously large smoothie. So, the outcome of investing in a combine harvester means large fields of a single crop – which, while more economically efficient, comes with a host of additional complications that are typically disruptive to the ecosystem.

Monocultural practices are positive in that they provide a much higher yield, which can feed a much larger population. This is incredibly important and not to be overlooked – feeding large populations is really important. However, the damage to the ecosystem can be devastating under certain conditions. Palm oil production is a classic example of a crop whose rise in demand is linked to high environmental impact via deforestation of the tropics. And we need to be careful that demand for “sustainable” bamboo products does not contribute to a similar trend.

So, either consumers pay more for the fruits of the labors (pun intended) required to farm in a sustainable way, or someone else foots the bill.

The former (consumers pay more for it) is where the evolution of the “labels” movement comes from – it is true that a subset of consumers are often willing to pay more for produce or goods labeled “Organic”. I’ll elaborate on this later. However, at a higher price – label or not – the demand for these more sustainable goods will be lower than the demand for the same good in the general population. Not as many people have the budget or the mindset to spend more for organic produce. As an example, if palm-oil free, organic peanut butter costs £7.85 per kg, but the store brand peanut butter costs £4.10, you can’t really judge the average consumer for choosing the cheaper option. Most people, especially in today’s high inflation environment, simply don’t have the luxury of choosing the more expensive option.

Consumers who are willing to pay for more sustainable products can rightly argue that they are paying more for something that benefits not just themselves, but the earth as a whole, and therefore its entire population. Economically speaking, the only way to align cost and benefit would be for all who benefit to contribute to the cost. Let’s look at where the costs and benefits originate and terminate. I bought organic palm-oil free peanut butter at the shop, but you live next door to the farm. Healthy soil can absorb water better than depleted soil, so you benefit from less flooding on your land, but you are not contributing to the cost of maintaining healthy soil. In that sense, I am paying for something that benefits you. While this is very kind of me, it isn’t an efficient economic transaction.

Should we rely on those with both the budget and the mindset to provide demand for produce that respects soil sustainability even though it costs more? If we pursue this route, we must accept that there will be others who benefit from this without contributing. Or should all those who benefit from this consumer choice somehow pay for the benefits received? In economics, this conundrum is described as the principle of externalities – elements (both positive and negative) that impact parties outside of those involved in the economic transaction.

Understanding Externalities

In economics, an externality or external cost is an indirect cost or benefit to an uninvolved third party that arises as an effect of another party’s activity. In layman’s terms, externalities measure the impact of economic transactions on those not included in the transaction. An example of a positive externality could be my choice to drive an electric car, as it reduces air pollution associated with petrol or diesel car exhaust, as these are the natural alternative choices of single driver transportation. An example of a negative externality would be the air pollution caused by petrol and diesel car exhaust.

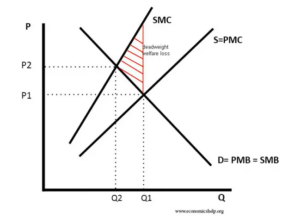

Factoring in an externality causes either the supply or demand curve to shift entirely to the right or to the left, which then impacts the market price paid where supply intersects demand. You can get more detail on the economics behind this at Economics Help. The conclusion, though, if you don’t want to wade through economic graphs, is that the intersection of supply and demand, which sets the market price and quantity sold, is in the wrong place when there is an externality.

If there is a positive externality present, the price is too high and the quantity sold too low. If there is a negative externality, the price is too low and the quantity sold is too high. In summary, we should buy more goods and services with positive externalities and fewer goods and services with negative externalities in order to achieve an efficient allocation of resources across the economy.

Many government policies are aimed at correcting market supply and demand curves to reflect economic externalities by subsidizing positive externalities (for example, exempting me from paying road tax if I have an electric car) and taxing negative externalities (for example, duties on petrol and diesel fuel). It is perfectly logical for government taxes and subsidies to work in this manner, as the economic markets are not functioning efficiently on their own.

The actors involved in the transaction – an oil company selling petrol and a person buying petrol for his/her car – have no incentive to also cover the additional cost to society of the air pollution created by driving a car powered by petrol fuel. And that cost is real.

The cost of air pollution to the government here in the UK is in part measured by the impact on the National Health Service (NHS). The total NHS and social care cost due to PM2.5 and NO2 combined in 2017 was estimated to be between £42.88 million and £157 million, depending on what level of association between disease and pollution is considered, according to Public Health England.

Sustainable choices, by their definition, quite often have the additional benefit to society baked into them. One could argue that in private markets, there is a slightly funky dynamic going on – because the societal benefits of these choices are being paid by the consumers willing to pay them. When, economically speaking, the most pareto optimal distribution of these costs would be to all who benefit. In order to achieve that, there would need to be administrative bodies measuring and reallocating costs and benefits across society.

Government policy is a rather blunt instrument, but externalities are often at the root cause of widely accepted government taxes and subsidies. What do we do when economic markets cross borders, however? Or, even more challenging – how do we stop consumers from outsourcing negative externalities, like pollution from plastic waste or emissions? In so many cases, we expect private markets to function under the principles of perfect competition – and market prices to cluster around the intersection of supply and demand.

However, when a negative externality (like air pollution) is present, supply for a commodity (like petrol) is artificially high; its intersection with the demand curve results in a price that is artificially low, and the resulting allocation of the commodity is inefficient. When a positive externality is present, supply for a commodity (like organic produce) is too low, and the price is too high. Intervention is required in order for markets to function appropriately. This intervention can come from governments, or through the exchange of information that separates markets into different segments. In the former, powerful lobbies often work to enhance government subsidies, or to prevent government taxation or regulation of commodities carrying negative externalities.

Political Dynamics of Managing Externalities

For more information on the dynamics between private companies with vested interests in selling more products and interest groups calling for government action, the example of the “UK Sugar Tax” sheds some light on the efforts required to achieve government action where a negative externality (in this case the detrimental impact on health of high levels of sugar consumption) is suspected in a market.

I do say “suspected” here purposefully. Agreement on what is an externality – and even more tricky, how much it impacts the market, is not forthcoming. Anytime an externality is up for debate, each side will present a case – each with vested interests, each with competing numbers, likely all compiled by economists, and likely stating diametrically opposed conclusions. Remember the estimate of the cost of air pollution? It came in at a range of over 100 million (from £42.88 million and £157 million)! The challenge with externalities is that the measurement of them can be subjective because they often represent complex societal costs and benefits without agreed market prices. When was the last time you estimated the benefit to yourself of breathing clean air? Did you give it a monetary value?

I thought about including an example here about the US gun lobby, and the extremely effective way the NRA has prevented gun legislation from limiting the sale of guns in the US. My premise was that the US government would be within its remit to regulate or tax gun sales in order to manage the cost to society of the nearly 49,000 gun deaths recorded in the US in 2021. As, that is a pretty big public health problem the US is facing.

I started to argue this point on the assumption that people being less likely to die from a gunshot wound was the more sustainable outcome from a societal point of view. But then I thought of the environmentalists that argue that overpopulation with humans is one of the earth’s biggest problems. So, then I really found myself in a quandary! Maybe my assumption that keeping people alive is the more sustainable end we should pursue is wrong after all – maybe letting the human population grow is less sustainable for the earth as a whole! So, I’m not going to use that example here…..yes, of course I am making a flippant joke about the value of human life in order to take the argument to its logical end to demonstrate how fraught these debates can be and how many conflicting viewpoints exist in each debate. Hopefully you see my point.

So, if we come back to our original question: why do sustainable choices cost more? The short answer is because the societal benefit of those choices are not priced into private markets. So, the prices you pay at the supermarket for more sustainable goods are often artificially high, from an economic perspective. They reflect an inefficient allocation of resources – if the market were to be corrected to account for externalities, sustainable products would be cheaper and more widely available in general.

Commercial Incentives and Segmenting Markets

Very few markets with externalities are corrected by government intervention. Often, we as consumers assume that commercial organizations would oppose government intervention. However, that is not always the case. McDonald’s was one of the first organizations to sign on to Mona Das’ bill calling for a ban of styrofoam packaging in Washington State. The large beverage companies are supportive of legislation banning non-recyclable, non-compostable packaging legislation in California and at the federal level. The primary reason: they want a level playing field and want to compete in a market in which there is a minimum level of responsibility.

It is much harder to compete in a market in which your competitors can use cheaper, more established, but also more irresponsible products (like styrofoam and non-recyclable plastics). Balancing cost performance against social responsibility is a challenge – and one that can be simplified by government policy, which, by pricing in externalities levels that competitive playing field.

However, government policy that reflects the additional costs and benefits associated with externalities are rare. To differentiate themselves in markets lacking policy support, many industry organizations have made efforts to segment markets – so that those who are able to spend more can choose more sustainable alternatives, despite their private market prices being higher than less sustainable alternatives. What is happening in this phenomenon is people with the budget and the inclination to buy more sustainable products and services are being segmented into a new market, for a “differentiated” good. This creates all sorts of perverse incentives, and is where the proclivity towards greenwashing originates. Where there are agreed standards for a certain threshold, like organic or non-Genetically Modified (GMO) or Forest Stewardship Council (FSC), consumers can choose to pay more for more sustainable products with more confidence that an independent third party has assessed the credentials.

Where the agreed standards are ill-defined, or can be twisted, this leaves an economic market rife for manipulation. Examples of manipulative marketing that pre-date greenwashing include advertising high-sugar food items as “low fat” or high cholesterol food items as “low carb”. Neither “low-fat” or “low-carb” mean that a piece of food is nutritionally sound, but it looks great on a label -and may make your product stand out next to the exact same recipe in the box next to it on the shelf that doesn’t advertise itself in line with the latest fad. To consumers who are time-poor and not informed of the context of these labels (it is impossible to be fully informed on anything!), these advertising strategies can effectively drive product sales.

Now that consumers are willing to pay more for more sustainable products, there is every incentive for a savvy product marketeer to slap “less plastic” or “climate friendly” on a label hoping it will catch the eye of a consumer looking to do the right thing. Neither of these terms, sadly, mean anything coherent.

Less plastic is great, but it isn’t a powerful statement if you reduced plastic use by 1 gram. There is no context to tell the consumer whether the reduction in plastic was significant or not. “Climate friendly” is another great marketing statement – sounds fantastic – but what does it mean? By whose definition? Let me guess – your company, the one trying to sell me the product labeled “climate friendly” has also determined the threshold for what makes a product “climate friendly”….hmmmm.

What is abundantly clear is that there are tricky incentives operating in this newly segmented market for eco-friendly goods. From an economic perspective, a perfectly competitive market relies on perfect information (a requirement never met in the real world). So, the argument that these segmented markets are not perfectly competitive is absolutely valid (if you haven’t already guessed, no perfectly competitive market has ever been observed in the real world).

What does it all mean for how should I shop?

Despite perfect competition not actually existing, there is some value in understanding which market forces are pulling upon segmented markets as they pull them away from perfect competition. By that, I mean that the more informed consumers are about what are and are not valid credentials, the closer to perfect competition we get. So, in layman’s terms, what that means is: an informed consumer has the opportunity to make better choices.

When you are buying eco-friendly goods, think critically about the information the product marketing specialists are putting in front of you. If it is a relative measure, like “reduced CO2” or “less plastic”, take it with a pinch of salt unless you can easily see what the starting and ending points are. Assign more value to third party accreditation, like leaping bunny for avoiding animal cruelty, FSC, Rainforest Alliance, USDA Organic, AB (Agriculture Biologique), B Corp Certification, and more. Ecolabel index provides a great resource for looking up these certifications to understand better against what standards they are measured.

In short, yes, if you want to buy more sustainable products, you are likely to pay a premium. If you have the luxury to do so, check the labels and look for third party certification to ensure that you are paying for actual green credentials, not just clever marketing.

There is a market benefit if we all buy with sustainability in mind – greater demand for sustainable goods will prompt a supply response. What that means is that the more we buy it, the more companies will start selling sustainable products. This increase in supply and competition will, over time, bring the price down.

And, finally, if you have the time and inclination, write to your political representatives and ask them to pursue government policies that address externalities. If the public understands when and where appropriately applied government policy can have beneficial outcomes, we are more likely to benefit from governance.

Further reading:

The many benefits of healthy soil

Costs to the NHS and social care due to air pollution

Science Direct Article: Agricultural Specialization

2 Trackbacks and Pingbacks